Proprietary services at its own sites, so that clients have nothing else to do but drive their cars. The Hungarian fleet management service offers unique solutions.

Mercarius Fleet Management Ltd. started in 1996, at the time under the name ÁgoStone, as a garage start-up. Initially the focus was on rent-a-car in the conventional sense, but since the car trade in Western Europe plummeted, they had to think of some unique operation – Róbert Koleszár Managing Director described the first period. Although fleet management was still in its infancy, they could see the potential. This is how Mercarius has become the dominant player on the Hungarian vehicle fleet management market within a period of twenty years. As to uniqueness, be it car rental, procurement of new vehicles, financing or multiple years long guaranteed fixed pricing mechanisms in addition to its core activity, Mercarius offers such auxiliaries without the restrictions customary elsewhere. As the company put it: they offer solutions meeting real needs. Cars are operated for a period of three or four years, clients pay fixed leasing fees and need to provide fuel only. The company expanded by exploiting the various financing sources and leasing arrangements, creating new service packages to client in parallel.

The company is fully owned by Hungarian proprietors right from the beginning and is distinguished from international fleet management businesses by the proprietary services provided by Mercarius on their own sites, so that clients have almost nothing else to do but driving.

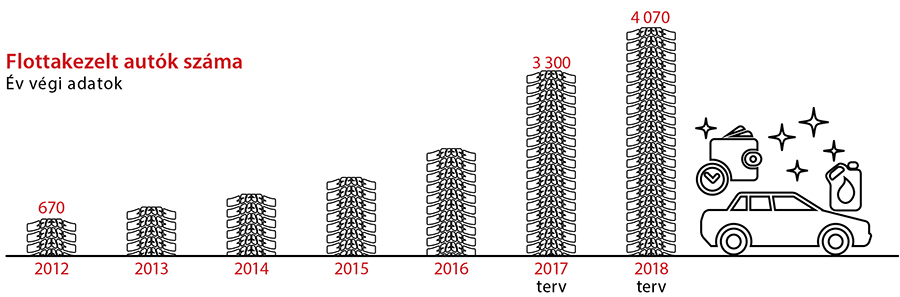

While in 2008 only thirty employees managed a total fleet of six hundred cars, today sixty people work here and the vehicle stock grew up to the thousands. One of the owners, Mr. László Szűcs, who joined the company in 2011 pointed out: the number of employees is expanded continuously practically without fluctuations. Dispatching operators do not change, tyres are still replaced by the same mechanics who did it long ago, in other words confidence is a hands-on experience in the life of the firm. Beside this reassuring permanence continuous growth is also present, thanks to the new owners as well, since the economic crisis could be survived only with their help. They developed a new business plan and strategy in collaboration with the management, for instance the clientele was revamped and foreign exchange exposure was downsized, supplemented by a capital injection as well.

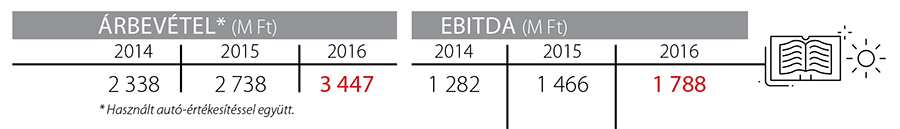

So what success is, according to the owner and the Managing Director? Beside the commitment enjoyed on the employee side, a HUF 2.9 billion gross income last year can be clearely marked as success. Also, success can be measured by the fact that since the change of owners not only turnover and total sales, but profitability was also improved.

They are also proud of the wide range of the economic sector their clientele encompasses. The key partners come from the energy industry and pharmaceuticals, but in the later years the public sector also accounts for an ever growing percentage of their orders. Last time a public procurement procedure of the Hungarian Railway MÁV was successfully accomplished. With this new development the company will become the third or fourth fleet manager of the domestic market. It can also be deemed to be a success that they do not need to peddle for money any more, the banks are eager to finance this business: contacts are maintained with 4 or 5 financial institutions. In terms of the future a recognisable trend is that credit institutions divest from fleet management due to the high level of risks entailed for them in the business, therefore the re-distribution of the market is started. The process may generate further growth. Company management finds it of paramount importance to get strong primarily within the country with their position stabilised in Hungary, in other words they do not envisage market penetration abroad at the time being.

It is not excluded that the company will be introduced on the Budapest stock exchange, since this move might bring along even more recognition and reputation, expected to expand the clientele even more. By the way, as a rapidly growing corporation operating on a high margin they have a strong quotation growth potential, thus an introduction on the stock exchange would be most probably smooth and without problems.

Source: bet.hu